Consumption Tax in Cyprus Scrapped

The Cypriot Government passed a new law on March 15th 2019 to change the way in which road tax and excise duty is levied on new and used imported cars. The bill was passed by a cross party agreement where 41 of the 48 MP’s supported the bill with just 2 abstaining (5 objecting). The law aims to penalize older, less efficient vehicles in a bid to cut pollution in line with many EU nations and reflects efforts made by governments across the globe. Whilst penalizing the most pollution cars it expects to promote the increase in sales and imports of more environmentally friendly cars.

Cyprus has been dubbed a graveyard of older, high polluting vehicles from all over Europe as whilst the worst offending vehicles, generally older diesel and large engined petrol models are penalized heavily elsewhere, Cyprus was seen as a soft touch where these vehicles were not heavily taxed and offered cheap motoring.

That is all set to change with the implementation of a new law that is now is in full force. The law affects excise duty on new and used cars imported to the island and it's road tax system. Whilst it is expected to cost the government around €15m (approx. €13m in lost taxation and €2m in lost VAT), the cross party support demonstrates Cyprus’ appetite to tackle its pollution problem and environmental impact head on.

How to Calculate Road Tax in Cyprus

Road tax in Cyprus is calculated by combining the flat rate tax based on the age and fuel type of the car, plus calcuating the specific taxable rate based on the CO2 (NEDC) emissions.

Flat Rate Road Tax in Cyprus

Classification

Model Year

Fuel

Pre March 2019 Tax

Post March 2019 Tax

Euro4

2005-2009

Diesel

€ 500

€ 600

Euro4

2005-2009

Petrol

€ 250

€ 300

Euro5 (a/b)

2009-2014

Diesel

€ 50

€ 250

Euro5 (a/b)

2009-2014

Petrol

€ 0

€ 100

Euro6

2014-2018

Diesel

€ 0

€ 0

Euro6

2014-2018

Petrol

€ 0

€ 0

CO2 Based Road Tax in Cyprus

CO2 (gr/km)

Pre-2019 Tax

Post 2019 Tax

Maximum Charge

no limit

€ 1,500

- Euro4 vehicles (those manufactured between September 2005 and August 2009) will be charged €600 for diesel and €300 for petrol models.

- Euro5a and Euro5b vehicles (those manufactured between September 2009 and August 2014) will be charged at €250 for diesel and €100 for petrol models.

- Euro6 vehicles (those manufactured between September 2014 to August 2018) will have zero tax applied, both diesel and petrol models.

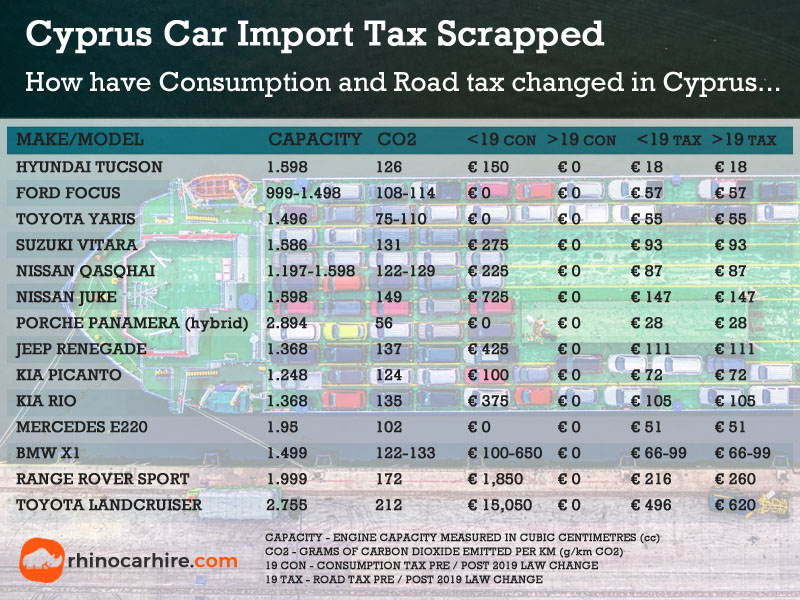

Example Road Tax Charges in Cyprus for New Cars

The below table shows some of the most popular model imports over the last 2 years and how the tax changes will affect certain models. It’s evident that the higher polluting, higher CO2 emitting vehicles will see the biggest excise duty tax savings with the Toyota Landcruiser tax being slashed from over €15,000 to zero (Euro6 onwards),

Brand

Capacity

CO2

Pre 2019 Duty

2019+ Duty

Pre 2019 Road Tax

2019+ Road Tax

HYUNDAI TUCSON

1.598

126

€ 150

€ 0

€ 18

€ 18

FORD FOCUS

999-1.498

108-114

€ 0

€ 0

€ 57

€ 57

TOYOTA YARIS

1.496

75-110

€ 0

€ 0

€ 55

€ 55

SUZUKI VITARA

1.586

131

€ 275

€ 0

€ 93

€ 93

NISSAN QASQHAI

1.197-1.598

122-129

€ 225

€ 0

€ 87

€ 87

NISSAN JUKE

1.598

149

€ 725

€ 0

€ 147

€ 147

PORCHE PANAMERA (hybrid)

2.894

56

€ 0

€ 0

€ 28

€ 28

JEEP RENEGADE

1.368

137

€ 425

€ 0

€ 111

€ 111

KIA PICANTO

1.248

124

€ 100

€ 0

€ 72

€ 72

KIA RIO

1.368

135

€ 375

€ 0

€ 105

€ 105

MERCEDES E220

1.95

102

€ 0

€ 0

€ 51

€ 51

BMW X1

1.499

122-133

€ 100-650

€ 0

66-99

66-99

LANDROVER RANGEROVER SPORT

1.999

172

€ 1,850

€ 0

€ 216

€ 260

TOYOTA LANDCRUISER

2.755

212

€ 15,050

€ 0

€ 496

€ 620

Theoretically, the maximum annual road tax in Cyprus would be for a EURO4 diesel model with CO2 emissions of over 300 gr/km. The €1,500 EUR cap would come into affect on the CO2 based scale in addition to the flat rate €600 resulting in a maximum road tax of €2,100 for a diesel car and €1,800 for a petrol model.

Cyprus Car Consumption Tax Scrapped

The shortfall in tax revenues from the scrappage of the Consumption Tax will be reclaimed from higher road tax incomes from older, higher polluting vehicles. Road tax for all cars will comprise a flat rate based on the age and fuel type, plus a calculated element based on the CO2 emissions as follows. with fee's ranging from € 0.5 per gr/km of CO2 emitted up to € 12 per gr/km with cap of € 1,500.

Incentives to Remove Older, Higher Polluting Cars

The bill also contains an incentive for people to dispose of older, high polluting cars. The headline policy being those that dispose of class M1 and N1 cars over 15 years and replace with a low emission vehicle will be exempt from any road tax for 5 years. Qualifying cars would need to emit less than 120 gr/km (CO2) and at just €0.5 per gram per km, the maximum saving would be €60 in the first year, €160 in year 2, €260 in year 3, €360 in year 4 and €560 in year 5.